Clark Wealth Partners - Questions

Clark Wealth Partners Things To Know Before You Get This

Table of ContentsAll about Clark Wealth PartnersThe 2-Minute Rule for Clark Wealth PartnersA Biased View of Clark Wealth PartnersGetting My Clark Wealth Partners To WorkClark Wealth Partners for DummiesClark Wealth Partners Can Be Fun For Everyone3 Simple Techniques For Clark Wealth PartnersNot known Incorrect Statements About Clark Wealth Partners

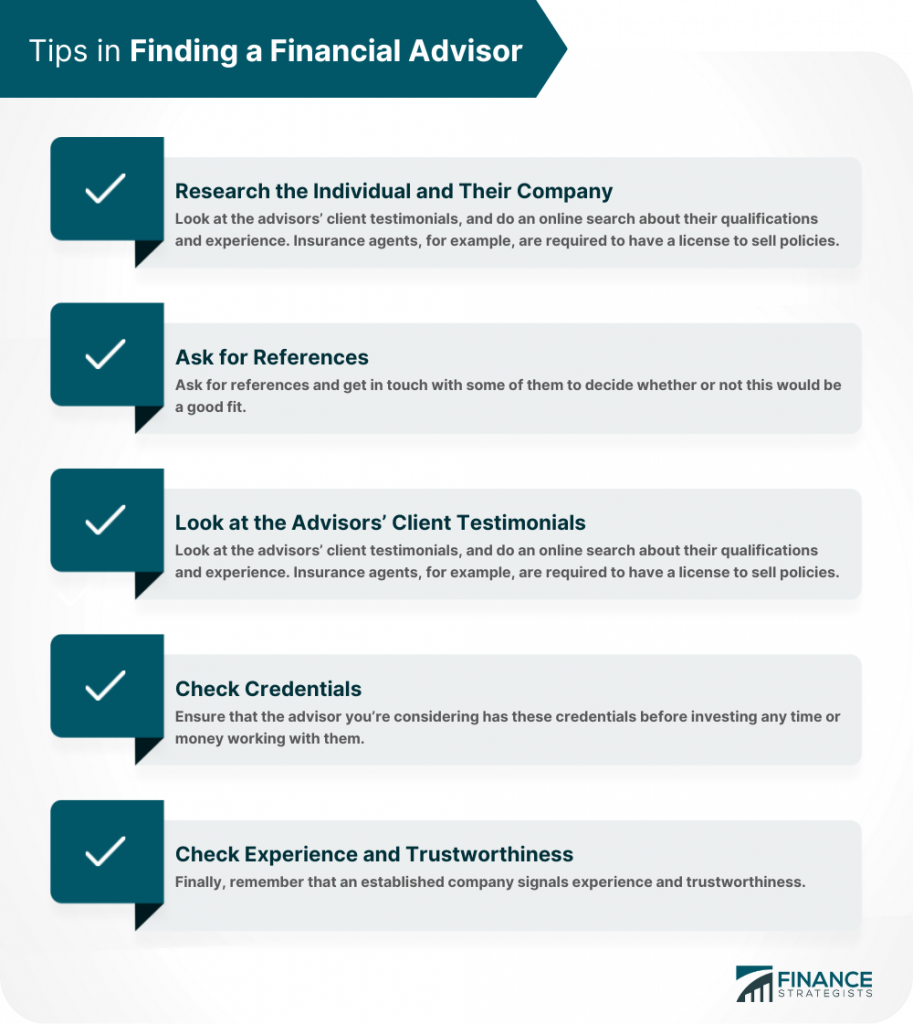

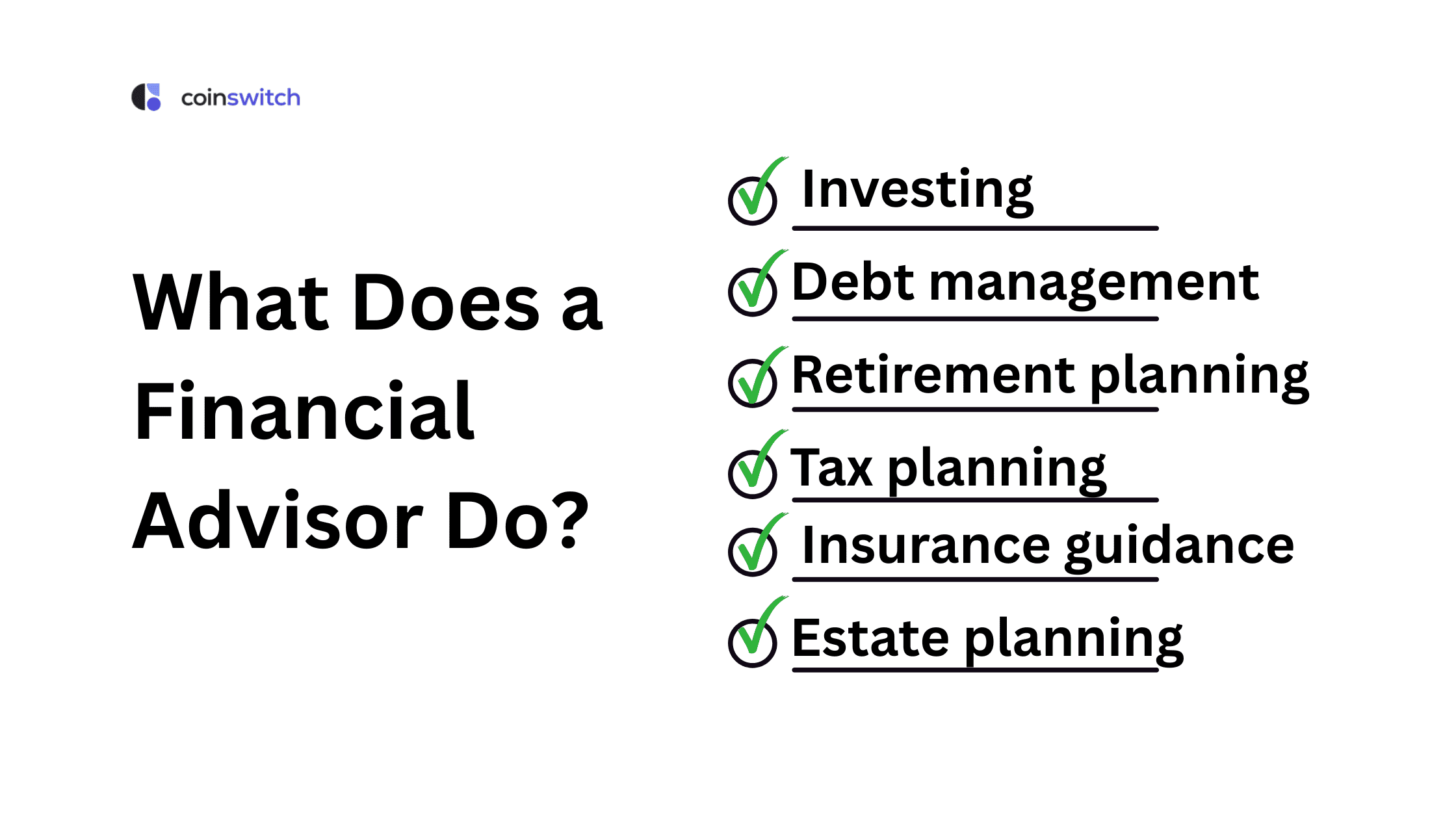

Usual reasons to think about a monetary advisor are: If your financial situation has ended up being a lot more complex, or you lack self-confidence in your money-managing skills. Saving or browsing significant life events like marriage, separation, children, inheritance, or task adjustment that may substantially affect your financial scenario. Browsing the shift from conserving for retired life to preserving wide range during retirement and exactly how to produce a strong retired life revenue strategy.New modern technology has brought about even more comprehensive automated financial devices, like robo-advisors. It depends on you to explore and determine the ideal fit - https://sandbox.zenodo.org/records/408042. Eventually, a great economic expert needs to be as conscious of your financial investments as they are with their very own, avoiding extreme costs, saving cash on taxes, and being as transparent as feasible concerning your gains and losses

Some Known Details About Clark Wealth Partners

Making a commission on item recommendations does not necessarily suggest your fee-based consultant antagonizes your ideal rate of interests. They may be much more inclined to advise products and services on which they make a compensation, which may or might not be in your best passion. A fiduciary is legitimately bound to put their client's passions.

They might comply with a loosely monitored "suitability" standard if they're not registered fiduciaries. This basic allows them to make suggestions for financial investments and services as long as they fit their customer's objectives, danger tolerance, and financial scenario. This can convert to referrals that will certainly likewise earn them money. On the various other hand, fiduciary consultants are lawfully obliged to act in their customer's best interest as opposed to their own.

Clark Wealth Partners for Dummies

ExperienceTessa reported on all points spending deep-diving right into complex monetary subjects, clarifying lesser-known investment methods, and revealing methods viewers can work the system to their advantage. As an individual finance specialist in her 20s, Tessa is really knowledgeable about the impacts time and unpredictability carry your investment choices.

It was a targeted ad, and it functioned. Review extra Review less.

Not known Factual Statements About Clark Wealth Partners

There's no single path to coming to be one, with some people starting in banking or insurance coverage, while others start in bookkeeping. A four-year degree supplies a solid foundation for careers in financial investments, budgeting, and client solutions.

Clark Wealth Partners Fundamentals Explained

Common examples include the FINRA Series 7 and Collection 65 tests for safety and securities, or a state-issued insurance license for offering life or medical insurance. While qualifications may not be lawfully required for all planning roles, employers and clients usually view them as a benchmark of professionalism and reliability. We check out optional qualifications in the next area.

Many monetary coordinators have 1-3 years of experience and familiarity with monetary products, conformity requirements, and direct customer communication. A strong educational background is important, yet experience shows the capability to use theory in real-world settings. Some programs integrate both, allowing you to complete coursework while gaining monitored hours with teaching fellowships and practicums.

Top Guidelines Of Clark Wealth Partners

Early years can bring long hours, pressure to develop a customer base, and the requirement to hop over to these guys consistently prove your competence. Financial planners take pleasure in the chance to function carefully with customers, guide essential life decisions, and often attain flexibility in routines or self-employment.

They spent much less time on the client-facing side of the industry. Virtually all economic managers hold a bachelor's degree, and several have an MBA or comparable graduate level.

Getting The Clark Wealth Partners To Work

Optional certifications, such as the CFP, typically call for additional coursework and screening, which can extend the timeline by a number of years. According to the Bureau of Labor Statistics, individual monetary consultants earn a mean annual annual wage of $102,140, with top income earners earning over $239,000.

In other provinces, there are guidelines that require them to meet specific demands to make use of the economic expert or financial planner titles. For financial coordinators, there are 3 typical classifications: Qualified, Individual and Registered Financial Organizer.

Facts About Clark Wealth Partners Revealed

Those on wage might have a reward to advertise the services and products their employers supply. Where to discover a monetary advisor will certainly rely on the kind of recommendations you need. These institutions have team that may aid you recognize and get specific kinds of investments. For example, term deposits, assured investment certifications (GICs) and shared funds.